Cluey Learning enters 2026 with renewed growth momentum, following key capital market activity and a strategic acquisition that expands its education technology footprint across Australia. Cluey’s strategy places it alongside other well-known education assistance franchises as demand for structured tutoring and hybrid learning models continues to rise.

Key 2026 Highlights

ASX Capital Expansion: Quotation of new securities has strengthened Cluey’s balance sheet, supporting platform development and scalable growth initiatives.

Strategic Acquisition: The acquisition of Education Futures Group positions Cluey to expand beyond online tutoring into hybrid and in-person learning models.

Broader Education Reach: Combined digital infrastructure and physical education services enhance Cluey’s ability to serve students nationwide.

2026 Outlook: Focus on operational efficiency, omnichannel learning, and long-term profitability as demand for flexible education rises.

Early Growth and Expansion Path

Cluey Learning was founded as an online-first tutoring platform, aiming to make personalised education more accessible to Australian students. In its early years, the company focused on building a scalable digital infrastructure, enabling one-to-one tutoring at national scale without the constraints of physical locations.

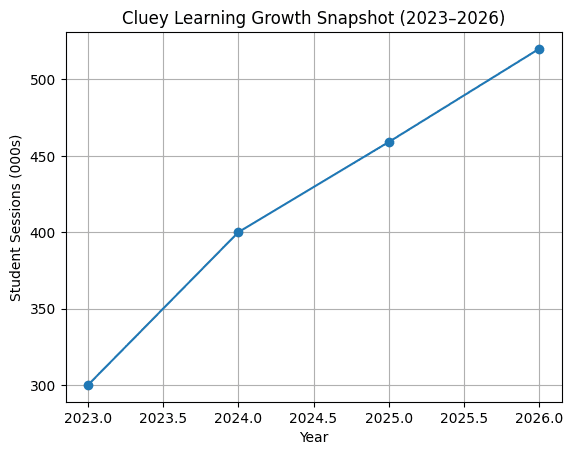

Through steady investment in technology and curriculum alignment, Cluey expanded its student base year on year, delivering hundreds of thousands of tutoring sessions annually. This growth helped establish Cluey as one of Australia’s leading online education providers and supported its successful listing on the Australian Securities Exchange.

In the years leading up to 2026, Cluey broadened its strategy to include hybrid learning models and strategic acquisitions. This evolution marked a shift from a purely digital service toward a more diversified education network, reflecting both its growth maturity and changing market demand.

Cluey Learning Growth Snapshot (2023–2026)

Why This Matters in 2026

✔ Strategic Acquisition: Buying Education Futures Group positions Cluey to extend reach through physical learning centres and in-person services alongside its digital model. (Source: NewsnReleases)

✔ Omnichannel Growth: Moving toward a blended education ecosystem aligns with rising demand for flexible learning across K-12.

✔ Capital Market Support: Equity issuance and asset growth moves demonstrate investor confidence amid Cluey’s shift to profitability.

✔ AI Innovation: Early adoption of AI tutors and curriculum automation gives Cluey an edge in personalised learning technology.

Cluey Ltd Announces Quotation of New Securities on ASX — The Globe and Mail

Cluey Ltd to Acquire Education Futures Group, Expanding EdTech Footprint — MSN

Matteo Trinca (Joint CEO) on FY25 Performance

“FY25 represents a significant milestone in Cluey’s journey. Over the past year, we delivered a significant $4.4 million improvement in EBITDA, achieved our first quarter of positive operating cash flow, and resumed an 11% growth in new student numbers — all while reducing costs and enhancing our operational efficiency. These results are the outcome of deliberate and disciplined execution.”(Source:ASX Announcements)

Matteo Trinca (Joint CEO) on Growth and Operational Efficiency

“We continue to see strong cost management through lower operating costs and the lowest-ever customer acquisition cost per student. We are encouraged by the significant improvement in new student growth… and remain optimistic about our return to top-line growth and our path to profitability.” (Source: Finclear News)