Introduction to Australia’s Burger Franchise Chain Market (2000-2025)

Australia’s burger industry is sizzling with opportunity.

With over 9,325 businesses and a 1.3% CAGR, burgers have carved out a permanent spot in Aussie dining culture and the market size of 11.5 billion in 2025, it is a place to be if you want to get into the food industry segment in Australia (IBISWorld and Geotechinfo)

The appeal lies in their speed, flavour, and flexibility.

From classic beef patties to gourmet, vegetarian, and plant-based creations, the market continues to evolve in response to modern tastes and dietary preferences. Australians are also leaning into delivery, convenience, and healthier options.

This trend has shaped a competitive franchise landscape between fast-food giants and premium gourmet innovators. Let’s dive into the top-performing burger franchises making waves in 2025.

Here is how the growth of the burger chains stands over the last 20 years :

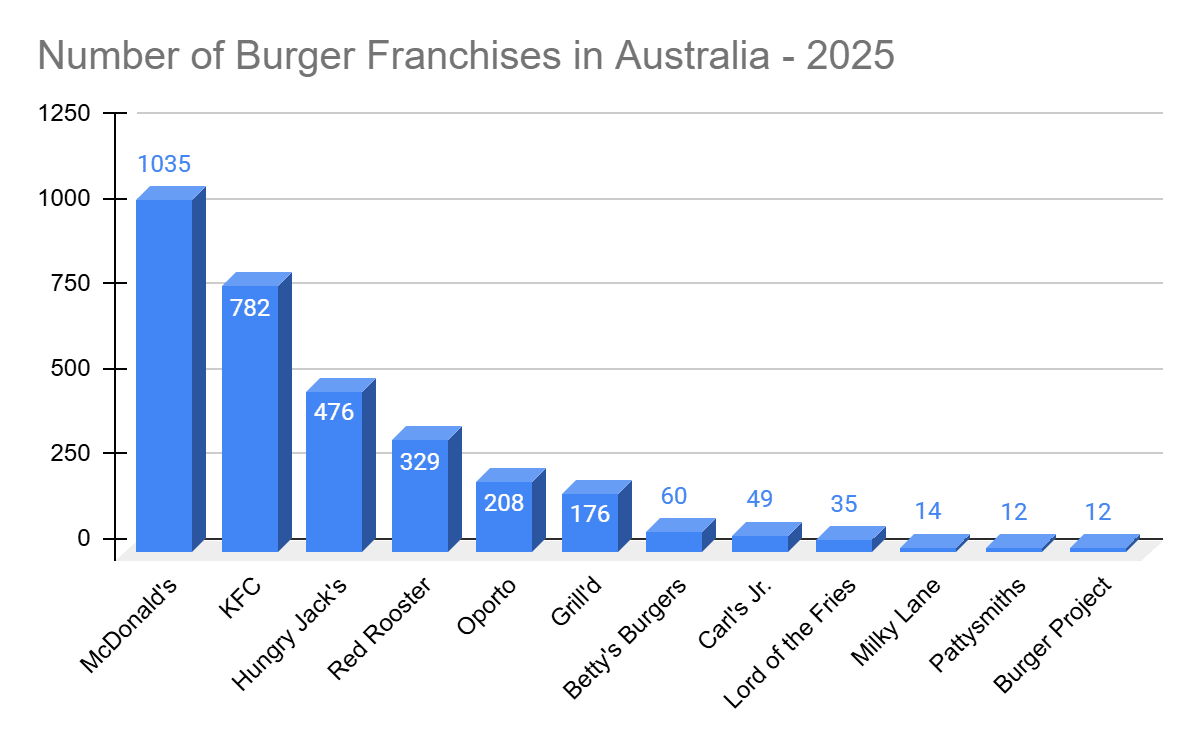

Before we get to the complete list, let’s look at Australia’s major burger franchise brands with numbers.

Major Burger Franchise Chains in Australia

With these statistics in mind, let’s head to the list of 12 Major Burger Franchise Chains in Australia.

| Locations | 1,033+ (Investopedia) |

| Investment | Approximately $2 million |

| Franchise Fee | $45,000 (RosterElf, SwoopFunding) |

McDonald’s leads Australia’s fast-food sector with a vast footprint and strong consumer loyalty. Franchisees gain access to global marketing power, cutting-edge delivery systems, and extensive training.

The company invests heavily in technology and sustainability initiatives, ensuring relevance in a shifting market.

| Locations | 449 (Wikipedia) |

| Investment | Around $2.6 million |

Australia’s homegrown Burger King equivalent offers a broad menu with flame-grilled favourites (it also happens to be one of Australia’s Top Chicken franchise chains). Hungry Jack’s has innovated with Jack’s Café outlets to diversify customer offerings.

Franchisees benefit from a proven business model, comprehensive operational support, and a legacy dating back to 1971.

| Locations | 150+ (Grill’d) |

| Investment | Approximately $546,000 + GST |

Originating in Melbourne, Grill’d appeals to health-conscious consumers with fresh, locally sourced ingredients, including grass-fed beef and vegan options.

Their Local Matters program supports community causes, and Grill’d was one of the first in their sector to become carbon neutral. Franchisees invest in a brand focused on sustainability and wellness trends.

| Locations | 23+ (Carl’s Jr. Australia) |

| Investment | Estimated $1 million+ |

Carl’s Jr. brings American diner vibes and large, chargrilled burgers to Australia.

With rapid expansion plans, drive-thru formats, and strong marketing, they compete directly with McDonald’s and Hungry Jack’s. Franchisees get a turnkey operation with established brand equity and ongoing promotional support.

| Locations | 180+ (Wikipedia) |

| Investment | $450,000 to $900,000 (Craveable Brands) |

Oporto is part of the Craveable Brands family and specialises in Portuguese-style grilled chicken burgers and wraps. Since 1986, it has focused on bold flavours and loyal customer bases.

Franchisees benefit from robust national marketing, supply chain management, and a diverse menu that extends beyond burgers.

| Investment | Estimated $500,000+ (Pattysmiths) |

Pattysmiths combines gourmet burger offerings with a small-store footprint. Their efficient, cozy locations appeal in urban and suburban areas, emphasising handcrafted quality and fast-casual convenience.

The brand is growing steadily as a premium alternative to traditional fast food.

| Locations | 29 (LinkedIn) |

| Investment | Around $450,000 to $600,000 |

Founded in Brisbane by the Carthew brothers, Burger Urge is known for its cheeky marketing and adventurous menu items, such as satay and BBQ jackfruit burgers.

Despite liquidation challenges, it has maintained a strong brand presence and loyal customer base.

| Locations | 60 (as of May 2024) (Betty’s Burgers) |

| Investment | Approximately $600,000 to $1 million |

Betty’s Burgers started in Noosa and has become famous for its all-Australian beef patties, “Concrete” frozen custards, and coastal-inspired vibe.

Their focus on consistency and warm hospitality supports their growth into high-traffic urban and regional areas.

| Locations | 10+ (News.com.au, Little Me Media) |

| Investment | From $400,000 upwards |

Milky Lane stands out with its fusion of gourmet burgers, boozy shakes, vibrant street culture, and social media engagement.

It has become a hotspot for millennials and Gen Z seeking a full sensory experience combining food, music, and atmosphere.

| Stronghold | Melbourne & major cities |

| Investment | Estimated $250,000–$400,000 |

| Locations | 35+ across Australia and New Zealand (QSR Media) |

Lord of the Fries is Australia’s leading plant-based fast food franchise, known for its ethical approach and inclusive menu.

Founded in 2004, the brand offers 100% vegetarian and mostly vegan options, including burgers, fries, hot dogs, and breakfast items.

With a cult-like following and growing interest in sustainable dining, the franchise appeals to socially conscious consumers seeking guilt-free indulgence. Its compact store format and low entry costs make it an attractive opportunity for new franchisees.

| Locations | 772 (as of 2024) (Statista) |

| Investment | Approx $1.5 million+ |

| Revenue | $1.1+ billion (Proxy Parisjc) |

While famous for chicken, KFC’s expanded burger menu and efficient delivery systems keep it competitive.

The brand is operated mainly by Collins Foods, emphasising consistent quality, innovative marketing, and digital engagement.

| Legacy | 50+ years (Wikipedia) |

| Investment | Estimated $1 million+ |

| Parent Group | Craveable Brands |

Red Rooster specialises in roast and fried chicken burgers, is Halal certified, and focuses on community involvement.

Recent digital upgrades and app loyalty programs demonstrate ongoing adaptation to market demands.

Australia’s burger fast food chain market is increasingly segmented:

Traditional fast food giants (McDonald’s, Hungry Jack’s, KFC) maintain mass appeal, while premium brands (Grill’d, Betty’s, Royal Stacks) cater to health-conscious and quality-driven consumers.

Trendy, youth-oriented brands like Milky Lane and Burger Urge leverage social media and vibrant branding to capture younger demographics.

Before investing, franchisees should carefully consider brand alignment, capital requirements, and digital readiness.

The burger appetite continues strong, offering diverse, lucrative franchise opportunities.

Make smarter franchise decisions with confidence. Learn how to assess opportunities based on costs, brand strength, market demand, and long-term growth.

Explore practical ways to finance your franchise. This guide walks you through loans, savings, investors, and grants—helping you secure the capital you need to launch with confidence.

Take the guesswork out of choosing a franchise. This checklist breaks down essential comparison points to help you assess opportunities and invest with confidence.

Turn your business idea into a thriving venture. Our Entrepreneurship Guide offers practical tips, essential tools, and real-world insights to help you start strong and scale with confidence.

Start optimizing your franchise investment today, gaining insights to navigate royalty fees and strategically guide your journey

Navigate the franchising landscape with clarity. Explore the 'Pros and Cons of Franchising' guide to make informed decisions for your business venture.

Research, explore and find your next franchise business to invest without a hitch. Our step by step guide makes the process simple and easy.